Financial reports, usually produced on a regularly scheduled basis, provide the opportunity for both management and board members to review an organization’s financial position.

Responsibility for an organization’s financial reporting is shared by management, the board and an external auditor. Management is responsible for preparing financial reports and developing internal financial controls; the board is responsible for overseeing management’s financial reporting processes and ensuring reporting exists to satisfy itself and external stakeholders; and the auditor is responsible for making an independent assessment of the financial statements and giving a professional opinion on whether they give a fair representation of the organization’s financial position.

Both management and the board should be reviewing financials on a regular basis. Management should create an environment where the board can ask enough questions.

While all three have different responsibilities in the process, board members may have the least experience in analyzing financial reporting. While not every financial report is set up exactly the same, there are some key statements board members should be familiar with, and questions they can ask to clarify their understanding an organization’s financial health.

KEY CONCEPTS TO KNOW

Key Accounting Terms

The glossary of terms used in accounting that board members should know includes concepts such as assets, liabilities, revenues, expenditures, accounts receivable, accounts payable, net assets, net revenue, contributions, working capital, etc.

Time Frame

All reporting is based on a time frame, which is different for different reports. Keep in mind, there is a difference between figures presented “at a point in time” — those figures calculated on a particular date, such as assets, liabilities and net assets — and figures presented as “cumulative sums over time,” which refer to the total financial value of an activity during a fixed period of time, such as revenues and expenditures.

TWO KEY FINANCIAL STATEMENTS

According to the Chartered Professional Accountants of Canada, there are two key financial statements board members should review on a regular basis as part of the budgeting process, monitoring of results, or review of the auditor’s financial statements: the Statement of Operations and the Statement of Financial Position.

Statement of Operations

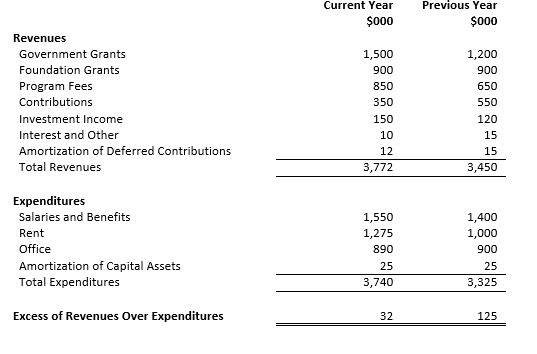

The Statement of Operations, or income statement, summarizes revenues and expenditures over a period of time. It also shows the net balance (in excess or deficit) of revenues over expenditures.

REVENUES – EXPENSES = EXCESS (OR DEFICIENCY) OF REVENUES OVER EXPENDITURES (also known as NET INCOME)

Revenues are the source of funds coming into the organization. Expenditures are the costs of doing business of the organization. Revenues and expenditures are organized in various categories (determined by the organization) usually ranked from largest to smallest.

Non-profit organizations are expected to spend whatever revenues are generated on program delivery — they are not expected to have a profit. However, a small operating surplus, intended to serve as a buffer against unforeseen eventualities, is not unreasonable.

Example of Statement of Operations

Clarifying Questions for Board Members to Ask

The first thing board members should do is compare the figures for the current year to the previous year. There may be changes over time that raise questions. The Chartered Professional Accountants of Canada (2012), recommends some additional questions when considering revenues and expenditures:

- Who provides each category of revenue to the organization and why? Are there restrictions on how these revenues are used?

- What are the costs associated with raising this kind of revenue? Is it worthwhile?

- What are our fundraising expenditures as a percentage of funds raised?

- Who are our competitors/collaborators for these revenues?

- Have we remained true to our mission in acquiring these revenues?

- Are there revenues devoted for a specific program, project or activity? Do they contribute to overhead?

- How secure is this revenue for future periods?

- What is the source of investment income? What is our target return on investments? Is this achievable in the current economic climate?

- What is included in other income, other revenues, or other expenses? Should any of these components be reported separately?

- What lies behind the expenditures on salaries and benefits? When did we last award raises and when is the next scheduled? What benefits do we provide our employees and what is the cost? How do we handle vacations and vacation pay? How does our compensation stack up in the marketplace?

- What spaces do we rent (or own)? Are they sufficient? What are the major lease/rental terms? How long until we have to move or negotiate a new lease?

- What is the policy for amortization of capital assets?

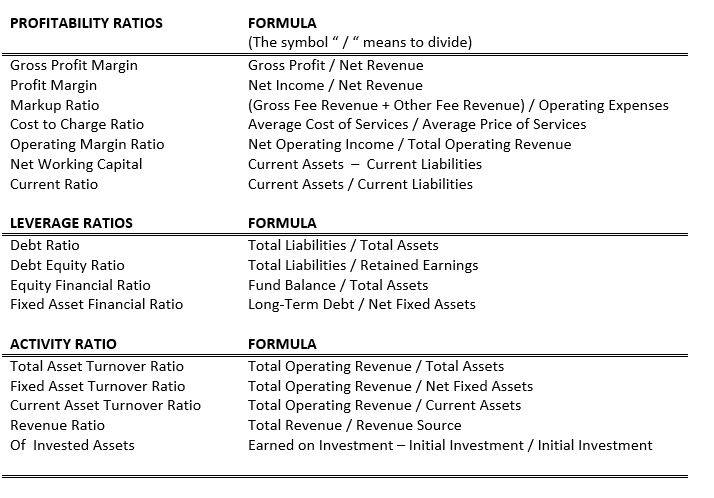

When reviewing the Statement of Operations, board members may use some formulas from the following chart for calculating changes from year to year — in particular, the formula for PERCENTAGE TOTAL REVENUES OVER REVENUE SOURCE.

Statement of Financial Position

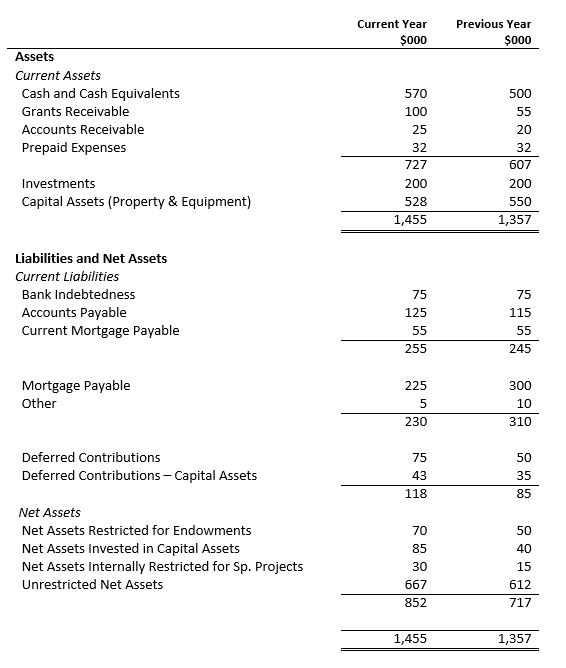

The Statement of Financial Position, sometimes called a Balance Sheet, demonstrates the organization’s financial position at a particular point in time. This report shows how the Total Assets equal the Sum of Total Liabilities and Net Assets.

TOTAL ASSETS = NET ASSETS + TOTAL LIABILITIES

NET ASSETS = TOTAL ASSETS – TOTAL LIABILITIES

The Statement of Financial Position organizes assets and liabilities based on how close each is to cash.

• Current Assets – available or easily available cash

• Current Liabilities – need to be paid in current year

• Long Term or “Fixed” Assets – not expected to become cash until future year

• Long-Term Liabilities – not expected to require payment within the next year

Most organizations will normally have more assets than liabilities. What is left over is shown as the balance or Net Assets, which is the net worth of the organization.

Example of Statement of Financial Position

Organization Name

As of December 31, 20XX

Clarifying Questions for Board Members to Ask

Once again, board members should begin by comparing the figures for the current year, compared to the previous year in the Statement of Financial Position. The Chartered Professional Accountants of Canada (2012), also recommends some additional questions:

- What are the components of cash and cash equivalents? Are any of these at risk of losing value?

- Who owes us the accounts receivable? What is the age profile of these accounts? Is there likely to be a problem collecting these amounts? Has any provision been taken for uncollectable amounts?

- What are the components of prepaid expenses? Do we have any choice about paying in advance?

- What are the major types of invested assets we hold? Do we have an investment policy? What are the risks associated with these types of investments?

- What are the capital assets we own? Where in the organization are they used? How are these assets depreciated or amortized? Do we have plans to replace these assets as needed?

- To whom do we owe accounts payable? Do we pay these amounts on a timely basis?

- What is the renewal date for the mortgages or loans outstanding? What is the interest rates? Is it still considered a good rate? Is cash available to pay down the loan sooner?

- What is included in other liabilities? To whom are these owed and why? Do we have the cash resources to pay them?

When reviewing the Statement of Financial Position, board members may use some formulas from the previous chart for calculating changes from year to year — in particular, the formulas for WORKING CAPITAL RATIO, PERCENTAGE CHANGE OF INVESTED ASSETS and PERCENTAGE CHANGE IN CAPITAL ASSETS.

The Statement of Operations and the Statement of Financial Position are linked. The investment income shown on the Statement of Operations is linked to the size of return on investment assets shown in the Statement of Financial Position.

OTHER STATEMENTS TO CONSIDER

Depending on the area of interest, there are other financial reports that provide useful information about the organization’s finances.

Statement of Cash Flows

The Statement of Cash Flows shows an organization’s generation and use of cash over a specified time period. It is made up of cash receipts and payments that arise from business set up by principal categories and uses.

Notes to Financial Statements

Notes to financial statements are additional information provided with the organization’s financial statements, which include: income statement, balance sheet and statement of cash flows. These notes are important disclosures that further explain the numbers in the financial reporting.

REGULAR FINANCIAL REVIEWS

Both management and the board should be reviewing financials on a regular basis. Management should create an environment where the board can ask enough questions. All board members should feel comfortable enough to ask questions as needed. However, it is important that questions are answered and then quickly returned to the board level to assess the issue from the strategic level.

Many boards develop a set of dashboard indicators that can be updated by management. When reviewed on a regular basis, these indicators help focus monitoring efforts.

Dive deeper on this topic

-

ChecklistChecklists for CharitiesCanadian Revenue Agency

-

GuideA Guide to Financial Statements for Not-for-Profit Organizations: Questions for Directors to Ask (2nd Edition)Chartered Professional Accountants of Canada

-

ArticleBasic Overview of U.S. Nonprofit Financial ManagementAuthenticity Consulting

-

PublicationKeeping the Record Straight: Introductory Accounting for Non-Profit OrganizationsCertified General Accountants of Ontario

-

WebinarNot-for-Profit Accounting Standards with KPMGImagine Canada